In this article, 1D3 tax expert Irina Cherkashina shares essential insights on VAT for digital services, crucial for game developers, SaaS providers, and digital goods merchants. This concise guide covers VAT basics, global rates, and compliance, helping you navigate the complexities of selling digital products internationally. Highlighting the importance of understanding VAT on digital services, it offers the clarity needed for smooth operations and compliance across borders. Whether expanding your digital business or starting anew, this article is a valuable resource for mastering VAT in the digital realm.

What are digital services in the context of value-added tax?

Digital services, as defined by various states and international organisations, generally encompass intangible goods that are digital in nature and can be purchased, transferred, and delivered online. These services cover a broad range of digital offerings, including but not limited to:

- Electronic data storage, such as cloud storage

- Downloads of software

- Mobile applications

- Email services

- File sharing

- Webinars

- Services provided by Internet Service Providers (ISPs)

- Online gaming and virtual goods within video games

- Online membership programs, including discussion forums

- Software licenses and their renewals

- Subscription services

- Telecommunication services, including both fixed-line and mobile

- Digital art

- Television and radio broadcasting

- Fees for access to trading platforms

- Online streaming services

- Downloads of videos and music

- E-books

- Online courses

- Web hosting services

It's also worth noting that tax laws do not differentiate between digital goods and services. The term "digital goods" is commonly used to refer to digital content sold online. Both are considered digital services from a legislative standpoint, whether selling a video game online or offering financial advice via Zoom.

The name of the tax imposed on digital services varies across countries, reflecting different tax regimes worldwide. For example, European countries, Switzerland and Turkey refer to it as VAT (Value-Added Tax), while countries like Canada, India, and Singapore use the term GST (Goods and Services Tax). In the USA and Malaysia, it's known as Sales Tax, and in Japan, it's referred to as Consumption Tax.

Despite the different names, all these taxes fall under the category of indirect taxes. Indirect taxes are those collected by the seller from the buyer at the point of sale. The seller then remits this tax to the government, acting as an intermediary between the buyer and the tax authorities. This system streamlines taxing digital services, ensuring compliance across diverse economic landscapes.

Why Do You Pay VAT on Digital Services?

The introduction of VAT on digital services aims to ensure that big internet companies pay taxes in the countries where their customers live. This rule is set to ensure fairness by treating both local and international companies the same when they sell services online. The goal is to create a fair and equal digital marketplace where every company pays taxes based on where their services are used, encouraging fair competition.

Who pays VAT on Digital Services?

When it comes to applying VAT (Value-Added Tax) on digital services, it matters whether the customer is an individual (or a non-VAT registered company) or a VAT-registered business. If a business is registered for VAT, most often, it won't be charged VAT by suppliers from other countries. However, if a customer doesn't have a VAT number, then suppliers from outside their country will add VAT to their purchases.

This system lets businesses with VAT registration manage the VAT on services they buy from other countries by reporting it in their VAT filings. This means suppliers from outside don't have to sign up for VAT in the customer's country, simplifying things and making sure VAT rules are properly followed. Local businesses handle the VAT themselves. However, if you sell digital services to people (not businesses), you must register for VAT in their country and include VAT in your prices.

What are the VAT rates on digital services?

There is no universal global rate VAT for digital services. Rates vary across countries and can differ based on the type of digital service provided. Additionally, certain digital services might be exempt from VAT. For instance, in some EU member states, products like e-books, online newspapers, and specific educational services benefit from reduced VAT rates or are completely VAT-exempt.

We should also keep in mind that these tax laws are constantly evolving. For example, up until January 1, 2024, Ireland applied a reduced VAT rate of 9% to e-books, unlike printed books, which had a zero rate. However, starting this year, these digital items will also enjoy a zero VAT rate.

The situation is more complex in the USA due to the diversity in sales tax legislation across different states, each with its own set of rules for taxable and exempt digital services. For instance, Software as a Service (SaaS) is exempt from sales tax in states like Arkansas, Idaho, Virginia, and California. For businesses offering digital services globally, it is crucial to be well-acquainted with the specific exemptions and reduced rates applicable in each country where they have customers.

Moreover, the USA has varied sales tax registration thresholds determined by sales revenue or transaction volume. For example, Alabama sets its threshold at $250,000 in sales revenue, while Georgia uses a criterion of 200 transactions. Some states, like Connecticut, employ both measures, requiring registration for businesses exceeding $100,000 in sales and 200 transactions. This layered approach underscores the importance of understanding local tax obligations to ensure compliance.

Are Subscriptions Considered Digital Services?

Subscriptions are subject to Value Added Tax (VAT) when they grant access to taxable goods or services. In most cases, the country's default VAT rate is applied. However, some subscriptions, such as those offered by professional bodies, trade unions, and charities can be VAT-exempt.

Taxation on subscriptions varies globally. In the USA, for example, the taxability of digital subscriptions, including streaming services, depends on the state. Some states, like Texas, tax a wide range of services, including subscriptions, while others, like Florida, do not typically require sales tax on SaaS products. This variation highlights the importance of understanding local tax laws for subscription-based businesses.

Calculating VAT for a subscription service

For companies offering subscription services, especially those based in the European Union (EU) like an Estonian company selling software subscriptions globally, compliance with specific VAT (Value Added Tax) requirements is essential. The calculation of VAT depends on several factors:

- The nature of the customer (i.e., whether they are a company or an individual).

- The customer's geographical location (within the EU, outside the EU, or in Estonia—the company's home country).

There are seven possible scenarios for determining the VAT rate based on these conditions:

- For companies within the EU (excluding Estonia) that provide a valid VAT number (verified in the VIES database), no VAT is applied. The invoice should reference the application of a "reverse charge."

- For companies based in Estonia, where the seller and customer are located in the same country, the Estonian VAT rate of 22% is applied.

- For EU-based companies that do not provide a valid VAT number, the VAT rate of the customer's country is applied.

- For companies outside the EU, the applicable VAT rate depends on the local VAT legislation and whether a taxpayer number is provided.

- For individuals within the EU, the VAT rate of the customer's country is applied.

- For individuals in Estonia, the Estonian VAT rate of 22% is applied.

- For individuals outside the EU, the application of the customer's country VAT rate depends on the local VAT legislation.

Understanding these conditions is crucial for businesses to ensure compliance with VAT regulations when selling software subscriptions to a global customer base.

How to Avoid Paying VAT on Digital Services

The concept of paying taxes for digital services in the customer's country is a relatively new global development. Due to this novelty, many small and medium-sized businesses are slow to register for VAT. Initially, laws targeting digital service providers from outside the country were designed to make big internet companies pay taxes where their customers live. These laws make it hard for well-known companies to avoid taxes because their activity is too visible.

However, smaller, less-known companies face almost a Shakespearean dilemma: to pay or not to pay. Unfortunately, for those trying to dodge these obligations, paying is the only correct answer. Ignoring tax laws can lead to severe consequences, from having a website blocked in a specific country to facing jail time for tax evasion.

Legislation is constantly evolving to enforce tax payments more strictly. Since the beginning of the year, European payment service providers have been required to manage payment information meticulously. They must collect, process, generate, transmit, and store all necessary payment details and report them to tax authorities as outlined in several EU directives and regulations. This initiative is part of a larger strategy to fight against international online fraud.

STRESS FREE VAT MANAGEMENT FOR DIGITAL SERVICES AND VIDEOGAMES

GET IN TOUCH WITH 1D3One effective strategy for simplifying tax compliance is opting for a Merchant of Record. Although this service won't exempt you from paying VAT on digital services, it can significantly reduce the costs related to tax registration across different jurisdictions, employing tax agents (which is mandatory in some countries), and handling tax payments. A Merchant of Record also ensures that your VAT payments are made punctually, helping you avoid late fees and other penalties.

VAT Rules for B2B Digital Services

In business-to-business (B2B) transactions, especially for services, the general rule is that taxation occurs where the customer is based. If the customer's company is registered for VAT in their country, digital services are subject to the reverse charge mechanism. This mechanism means the supplier does not add VAT to the invoice. Instead, the customer is responsible for both paying and reclaiming VAT through their VAT return. Essentially, the reverse charge shifts the responsibility for accounting for VAT from the seller to the buyer.

In the EU, a critical step in this process is verifying the customer's VAT number in the VIES (VAT Information Exchange System) database. This validation is essential because if the customer does not have a VAT number or it's invalid, the seller must apply the VAT rate of the customer's country to the transaction. In situations where the customer lacks a valid VAT number, it signifies that the supplier is required to charge VAT on the sale of the service.

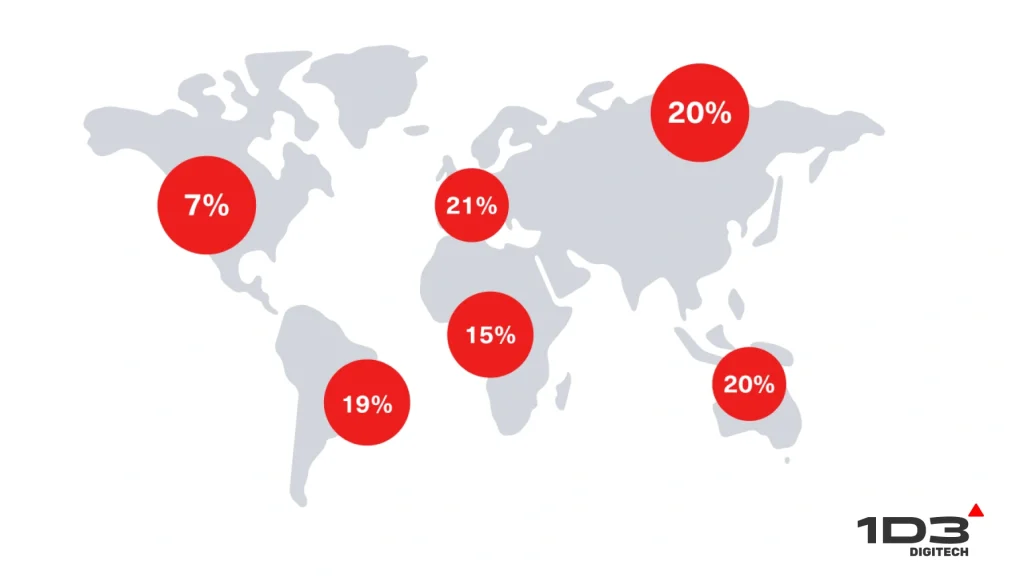

VAT on Digital Services Worldwide

Although it's not feasible to detail every VAT rate, regulation, and procedure for every jurisdiction in a single article, we've compiled a selection of examples to showcase the wide range of VAT procedures found around the world.

Chile

New rules for collecting VAT on digital services provided by non-resident companies were implemented on June 1, 2020, setting the VAT rate at 19%. Unlike many jurisdictions, there is no threshold for VAT registration; all providers must comply regardless of their revenue.

To enforce these rules, the Chilean tax authority (Servicio de Impuestos Internos, SII) introduced Resolution No. 49 on May 31, 2022. This resolution identifies 32 non-resident digital service providers for VAT withholding by banks and other payment processors.

Typically, this includes providers who have not registered under the simplified regime or have failed to meet their tax obligations. The SII will update this list quarterly, removing providers that no longer meet the criteria, with changes effective from the start of the following month.

As of December 2023, the SII has collected over USD 1 billion in VAT from registered digital service platforms. It's also worth noting that non-resident providers are not required to have a local tax representative in Chile.

Ecuador

Since September 2020, digital services in Ecuador have been subject to a 12% VAT, with no threshold for VAT registration. These services broadly cover:

- Web and data hosting, including data storage solutions.

- Online advertising services.

- Digital software, encompassing both downloads and Software as a Service (SaaS).

- Streaming or online access to videos, music, games, sports events, e-books, and similar content.

- Fully automated online distance learning courses.

- Online dating services and memberships to various online clubs.

- Services related to accommodation, auctions, gigs, and the sharing economy.

- Digital news platforms, blogs, and journals.

- Online technical and administrative support.

- Data processing services that rely on user-inputted or uploaded information.

For foreign suppliers not registered in Ecuador, withholding and remittance mechanisms enforce the standard 12% VAT rate. Specifically:

- In business-to-business (B2B) transactions, the importer of the digital service is responsible for VAT payment via the reverse charge method.

- In business-to-consumer (B2C) transactions, the intermediary handling the payment, such as credit or debit card issuers, is tasked with withholding and remitting the VAT.

It's also noted that appointing a local tax representative in Ecuador is not a requirement for foreign digital service providers.

Philippines

As of January 30, 2024, electronic services provided to consumers (B2C) in the Philippines are subject to a 12% VAT. The VAT registration threshold for providers of such services is set at 3 million PHP. Notably, foreign providers are not required to have a local tax representative.

Taxable electronic services encompass a wide range of digital offerings, including:

- Licensing of software products.

- Provision of database and online telecommunications services.

- E-learning services, with the exception of those offered by public educators, are exempt.

- Streaming and downloading of media content.

- Distribution of mobile applications.

- Sale of e-books and digital newspapers.

- Software as a Service (SaaS) and other cloud-based software solutions.

- Web hosting and various other internet services.

- Online advertising platforms.

- Subscriptions to online dating services.

- Online gaming services.

- Search engine functionalities.

This comprehensive list highlights the breadth of digital services now falling under VAT regulations in the Philippines, aiming to streamline tax collection in the digital economy.

South Africa

Since June 2014, electronic services supplied to consumers in South Africa are subject to a 15% VAT. This requirement was expanded on April 1, 2019, to include B2B (business-to-business) services when provided to South African businesses by foreign providers. Consequently, there is no longer a distinction between B2B and B2C (business-to-consumer) supplies, with VAT applied at the standard rate for both types of transactions. The threshold for VAT registration is set at 1 million ZAR. It is also worth noting that appointing a local tax representative for foreign service providers is optional.

Macedonia

Beginning January 1, 2024, foreign suppliers providing electronically supplied services in Macedonia must register for VAT and adhere to all related VAT requirements. Typically, hiring a local tax representative will be mandatory. This domestic financial representative will handle all VAT compliance duties required by Macedonian law for the foreign supplier. Importantly, there is no registration threshold; foreign suppliers must charge VAT starting from their first sale to a resident of Macedonia.

Conclusion

Navigating the complexities of global VAT compliance, with its varying rates and procedures across multiple jurisdictions, presents a significant challenge for digital service providers. The intricacies of managing these obligations can divert valuable resources and focus from core business operations. Given this backdrop, partnering with a Merchant of Record, such as 1d3 Digitech, emerges as a wise strategy.

1D3 Digitech offers comprehensive coverage of all VAT-related requirements for digital service providers, from handling registration to managing filings and ensuring compliance. This partnership allows businesses to concentrate on growth and innovation, secure in the knowledge that their VAT obligations are expertly managed.